| 45.9% of our turnover |

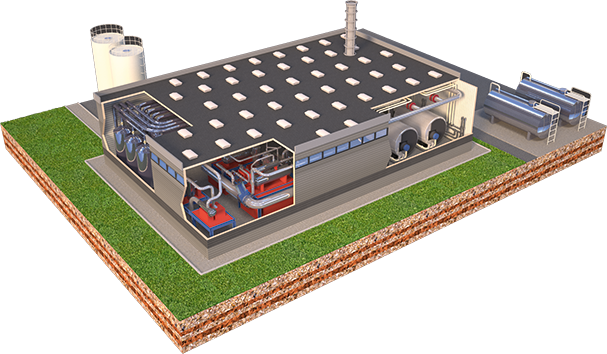

Fluid circuits in construction

|

|

|

80% of our sales in maintenance and renovation

37.8 million housing units in France, of which 5.2m are poorly insulated

620,000 energy optimisations in 2023 using state aid

We offer the private housing, collective housing and tertiary sector building markets all the accessories and equipment they need for effective water circulation in heating and sanitation facilities.

We also offer comprehensive ranges to control inside air quality and temperature. Our subsidiaries serve wholesalers, DIY superstores, web platforms and certain manufacturers.

Changes to the regulations (RE2020) which target water and energy savings, whilst ensuring comfort and security of housing and users are stimulating innovation and have led us to propose higher value-added solutions.

MaPrimeRenov’, financed by the public authorities, and the Energy Saving Certificates, financed by the energy suppliers, financed by energy companies, represent a theoretical sum of around €10bn for 2024. Energy use is the main source of greenhouse gas emissions in France, accounting for 297 Mt CO2 in 2019, or 68.1% of the national total. Residential and tertiary buildings emit 23 Mt, making energy renovation a national priority for many years to come.

Most of our business is in maintenance and renovation; these are resilient ‘needs’ markets on which we are very well placed and highly reactive.

Domestic pumps

(watering, swimming pool, lifting, rainwater harvesting)

| 16.3% of our turnover |

|

|

|

13 million gardens in France, one or more pumps per garden

1.3 million inground pools in France

Domestic waste water lifting: 5 million housing units in non-collective sanitation, 2 million of which to be made compliant

We are a major player on the French market for domestic pumps for professional distribution circuits and in DIY superstores.

Whether it be watering, irrigation, water supply to private houses, transfer and lifting of fresh and waste water or swimming pools, the pump market is, and will remain, important to us.

Successive heatwaves and floods over recent years have contributed to increasing needs, although they do remain subservient to the vagaries of the weather.

Our return to the swimming pool market has seen us bring a very wide range of equipment to professionals who build and refurbish pools.

Heavy tooling for public, professional and industrial customers

| 7.7% of our turnover |

|

|

€92m the DIY superstore market for Compressors, Generators and Welding Units

€100m The market for High-Pressure Cleaners in DIY superstores

€140m or 110,000 compressors. The air compressor market via the pro channel

We sell air compressors, generators, welding units, chargers and high-pressure cleaners to major retail and via the Web to well-informed DIYers.

We sell air compressors, generators, welding units, chargers and high-pressure cleaners to major retail and via the Web to wellinformed DIYers.

To differentiate the product offering targeting the different actors of the DIY sector, we use our own brands (Mecafer), those of our customers, and also brands used under licence by our suppliers (Michelin, Stanley).

Under the Nuair and Fini brands, we also sell our piston and screw compressors to professionals in industry, which complete the reservoir and valve ranges already distributed to wholesalers of industrial supplies, compressed air specialists and distributors of supplies for the automotive industry.

Fluid circuits in industry

| 22.9% of our turnover |

|

|

Chemical and petrochemical industry

Food industry

Pharmaceutical industry

Fluids circulate on most industrial sites in liquid or gas form. Six of our subsidiaries distribute manual and motorised valves, check valves, filters, connectors and regulation and control accessories for maintenance work or new installations.

We are present with almost all the specialised retailers, wholesalers in industrial valves and industrial supplies, and we are progressively building our product range. We also carry out specifier campaigns in factories to raise awareness about our ranges and establish our brands.

Sodeco Valves, based in Belgium, primarily targets major industrial sites. This market should remain dynamic in the medium term due to Europe’s desire to regain independence in strategic sectors and make the necessary investments in energy renovation.

Pipework for public works

| 7.2% of our turnover |

|

200,000 tonnes of plastic piping for wet and dry networks sold on the French market

Renovation of existing wet networks in France following the 2019 water conference - more than 1,000,000 km of drinking water pipework and 380,000 km of wastewater pipework.

Our plastic pipes (ducts, pipes and tubes, sheaths, drains, fittings, etc.) are used for drinking water, wastewater, irrigation, watering, drainage, dredging, gas and biogas, as well as telecommunications, electricity and fibre optic networks.

Our customers are specialist wholesalers and m ajor players in markets such as construction, public works, network design and construction and irrigation.

en

en  fr

fr